In this series, TechNexus outlines ways corporations can stay innovative, defend against disruption, and better connect with startups.

Planes, trains, and automobiles.

Update that for 2024, and the new phrase might be fuel-efficient planes, bullet trains, electric vehicles, e-scooters, and e-bikes. Regardless of your mode of transportation, mobility is part of your everyday life. How to get from point A to point B is a decision each of us makes multiple times per day, often without even realizing it.

TechNexus Venture Collaborative has been an active investor in the mobility space for the last several years, building on partnerships with corporations including Brunswick, Thor, and AAR. Through market research and conversations with thousands of founders and dozens of corporate executives, we learned that sustainable mobility is a crucial subset of the mobility space. Indeed, more and more, we talk with stakeholders about how all mobility needs to be sustainable.

So what do corporations need to know about sustainable mobility? Read on to learn more.

What do we mean by sustainable mobility?

When TechNexus talks about sustainable mobility, we are referring to the industry sector focused on transportation solutions that aim to reduce environmental impact, improve efficiency, and promote social equity. It includes energy, electric vehicles (EVs), and charging infrastructure, and the market is undergoing rapid growth driven by regulatory changes, technological advancements, and significant investments.

Governments are enforcing stricter emissions regulations and offering incentives for EV adoption, while the automotive industry shifts towards electric fleets with improved battery technology and alternative fuels. Innovations in fast-charging networks and smart grids, including vehicle-to-grid (V2G) technology, are integrating EVs into the energy ecosystem and improving consumer convenience. Additionally, the emphasis on renewable energy sources for powering EVs and substantial investments in charging infrastructure by both governments and private entities are addressing adoption barriers.

TechNexus, our corporate partners, and our portfolio companies care about this space because the trends collectively propel the market towards a more sustainable, efficient, and technologically advanced future.

What are the subsets of sustainable mobility?

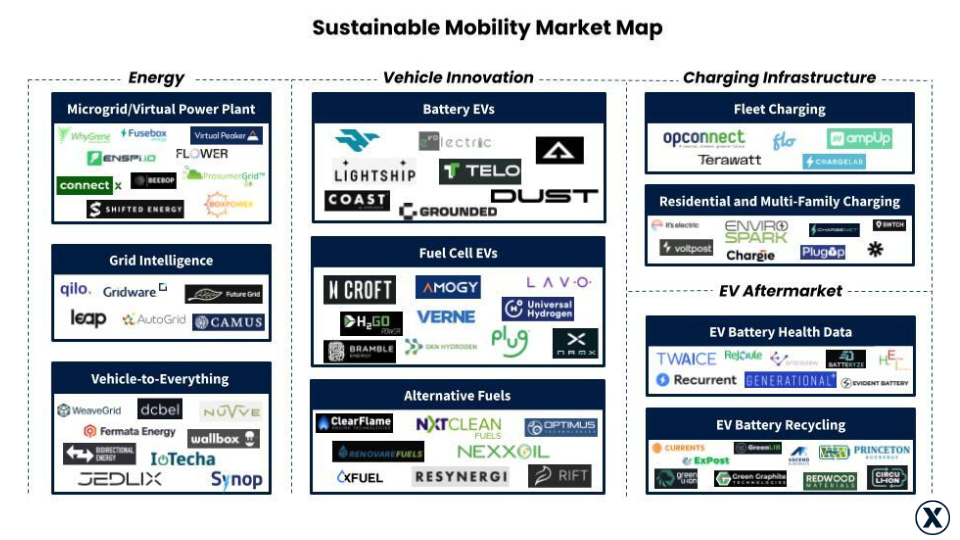

Currently, TechNexus is paying close attention to a few key subsets of the sustainable mobility market – Energy (including microgrids and virtual power plants, grid intelligence, and vehicle-to-everything, Vehicle Innovation, including battery EVs, fuel cell EVs, and alternative fuels), Charging Infrastructure (including fleet charging, residential and multi-family charging), and EV Aftermarket (including EV battery health data and EV battery recycling). We’ve mapped some key players and new entrants that we are following in each subset below.

What’s going on in each of these areas?

As active investors in the space, TechNexus is closely monitoring the industry trends and news. Here’s what corporations need to know about what’s going on in each category.

Energy

- The DOE’s Grid Resilience and Innovation Partnerships (GRIP) Program aims to enhance grid resilience and reliability through $3.9 billion in strategic investments for innovative grid modernization projects. The program supports the development and deployment of technologies such as microgrids, virtual power plants, and advanced grid intelligence to ensure a more robust and adaptable energy infrastructure.

- Microgrid Expansion is key. Expect increased deployment of microgrids to enhance energy resilience and reliability, particularly in remote or underserved areas, and to support renewable energy integration.

- Virtual Power Plants (VPPs). The industry will see growth of VPPs leveraging distributed energy resources (DERs) to aggregate and optimize power generation and consumption, providing grid stability and reducing reliance on traditional power plants.

- Vehicle-to-Everything (V2X). Advancements in V2X technology enable EVs to communicate with the grid, buildings, and other infrastructure, facilitating energy storage, grid balancing, and efficient energy use.

- Grid Intelligence and Automation. Implementation of advanced grid management systems using AI/ML to predict energy demand, manage load, and enhance grid reliability and efficiency will naturally follow other technology advancements.

Vehicle Innovation

- EV Tax Credits. Many governments offer tax credits and incentives to encourage the adoption of electric vehicles. These financial incentives can significantly reduce the purchase price of EVs, making them more accessible to consumers and promoting the shift towards cleaner transportation options.

- Fuel Cell Electric Vehicles (FCEVs) Allow For Quick Charge. FCEVs significantly reduce vehicle refueling time from over an hour, typical of battery electric vehicles (BEVs), to just a few minutes.

- FCEVs Have increased Energy Density. Hydrogen fuel cells are approximately 25 times more energy-dense than lithium-ion batteries, offering greater range with less weight. FCEVs emit no greenhouse gas, producing only water vapor and warm air as byproducts.

- Alternative Fuels. Utilizing alternative fuels allows fleet owners to reduce emissions without the need to replace their existing fleet with net new electric vehicles.

- Battery Innovations. Advances in battery technology, such as solid-state batteries, will enable BEVs to achieve greater range without the added weight of traditional batteries.

Charging Infrastructure

- DOE funding. The “Charging and Fueling Infrastructure (CFI) Discretionary Grant Program” provides $2.5 billion to support charging infrastructure deployment in urban and rural areas, enhancing the accessibility and reliability of EV charging networks nationwide.

- Transmission Interconnection Queue Backlog. The backlog in the transmission interconnection queue poses a significant challenge for the rapid deployment of EV chargers, as it delays the connection of charging infrastructure to the grid. This backlog results in prolonged wait times for EV charger installations, hindering the expansion of charging networks and potentially slowing down the adoption of electric vehicles.

- Behind-the-Meter EV Charging Installations. Behind-the-meter EV charging installations, where charging infrastructure is installed on-site and directly connected to a building’s electrical system, are becoming increasingly relevant. These installations offer benefits such as reduced strain on the grid during peak demand periods, increased flexibility in managing energy consumption, and potential cost savings for building owners through demand response programs or time-of-use pricing strategies. Additionally, they can facilitate the integration of renewable energy sources and energy storage systems, contributing to a more resilient and sustainable energy ecosystem.

EV Aftermarket

- EV Battery Health Data Is Critical. Real-time monitoring and analysis of EV battery health data, including temperature, voltage, and state of charge, is on the rise, driven by advanced sensors and telematics systems. This data helps optimize battery performance, extend battery life, and ensure vehicle reliability. For instance, Tesla’s vehicles collect around 25 GB of data per hour, including battery health metrics.

- Regulatory Focus on EV Battery Recycling. Governments globally are enacting regulations to address the recycling and disposal of EV batteries. For example, the EU mandates that at least 95% of EV batteries be recycled, promoting environmental sustainability and circular economy principles. In the US, the Battery Recycling Prize aims to develop innovative technologies for EV battery recycling.

- Importance of EV Battery Health Data and Recycling. Accurate battery health data enables proactive maintenance and diagnostics, benefiting automakers, fleet operators, and battery manufacturers. This data-driven approach can save costs and enhance efficiency. Additionally, EV battery recycling is crucial for mitigating environmental impacts. Recycling one EV battery can recover materials like lithium, cobalt, and nickel, reducing the demand for raw materials and minimizing waste disposal. A typical EV battery contains around 30 kg of lithium, which can be reused in new battery production.

Why should corporations invest in sustainable mobility?

Investing in the sustainable mobility market is a compelling opportunity backed by concrete data and trends. Globally, governments are enforcing stricter emissions regulations and offering incentives for EV adoption, resulting in a significant surge in EV sales. Additionally, the market for charging infrastructure is growing rapidly, with the global EV charging station market expected to reach $39.2 billion by 2027, driven by increasing EV adoption and supportive government policies. Advancements in battery technology, such as solid-state batteries, are enhancing the performance and range of EVs, contributing to their growing popularity among consumers. Despite challenges like the backlog in transmission interconnection queues, innovative solutions like behind-the-meter EV charging installations are emerging to address these issues and drive market expansion. Overall, with growing demand, regulatory support, and technological innovation, investing in the sustainable mobility market presents a lucrative opportunity for investors aiming to capitalize on the transition towards a cleaner and more efficient transportation ecosystem.

If you’re interested in learning more about what corporations need to know about sustainable mobility, please reach out to Kaitlyn Doyle, VP at TechNexus.

Special thanks to Sammie Hasen for her research and investment sourcing for this article.