By Declan Zidar, Sr. Associate, Venturing

A perfect storm of economic, regulatory, and social factors are driving both incumbents and startups to invest in long-term electrification plays. The category has picked up steam since we last wrote about it a few years ago. According to PitchBook, the global EV market is expected to grow from just over half a trillion dollars in 2023 to $1.6 trillion in 2030, presenting significant growth opportunities for mature companies that can take advantage of electrification. The opposite is also true for companies that ignore or do not evolve as this technology matures. Tom Randall, senior reporter at Bloomberg, noted that by the end of 2023, 31 countries had surpassed a pivotal EV tipping point: 5% of their new car sales were purely electric. This is up from 19 countries in 2022, a 48% increase in adoption. There are even greater, near-term opportunities for electrifying commercial and industrial assets as well. In short, it is time to act or get left behind when it comes to electrification investing.

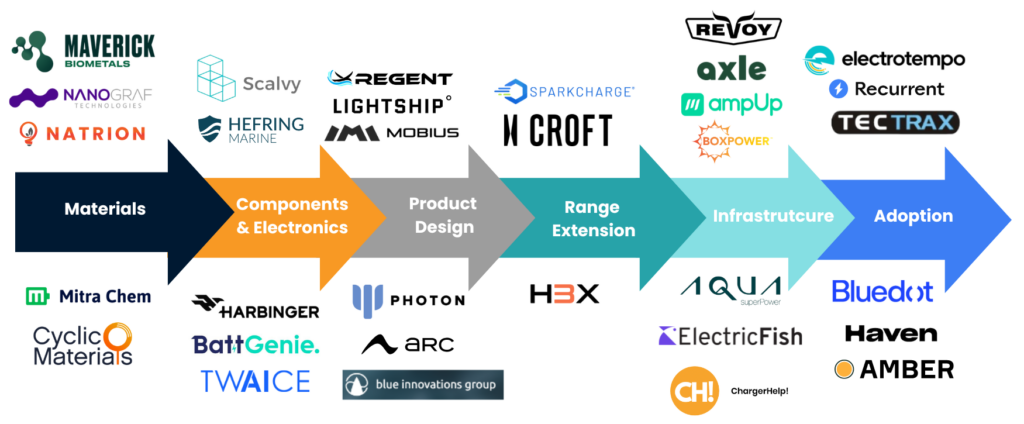

Our corporate partnerships with some of the largest, industry-leading original equipment manufacturers (OEMs) in Automotive, RVs, Marine, and Powersports have given us a holistic viewpoint to invest across the entire electrification value chain. There are two major aspects to successfully building an e-mobility investment strategy. First, investing in early-stage ventures upstream builds lasting relationships with key innovators, provides insight into crucial supply chains, and helps qualify for subsidies and meet regulatory standards. Second, investing downstream ensures these e-mobility products have the range, ease of use, infrastructure, and adoption required to advance the entire sector forward. In the sections below, we segment these parts of the value chain into six distinct categories. Understanding how these categories interact can be the difference between a successful product launch and years of wasted internal R&D.

“Electrification is not an ‘if’, it’s a ‘when’. Leaders in manufacturing are preparing for this change, and many are working with TechNexus to invest in emerging technologies all across the value chain. Corporations that don’t invest in this space now will be left behind.” -Fred Hoch, Founder and General Partner, TechNexus

The Electrification Value Chain

- Materials

Critical metals (i.e. lithium, nickel, and copper) are key inputs to EV batteries and consumer electronics worldwide, but they have complex supply chains, regulatory implications, and geopolitical risks. Check out Volta Foundation’s Annual Battery Report which summarizes the most significant developments in the battery industry.

Insider Perspective: “Critical minerals underpin the largest growing industries powering our economy, including compute, energy infrastructure, and EVs. However, the industry has historically been underinvested and relies on antiquated, dirty, and slow processes, whether it is in how data is collected for exploration or how metals are recycled at the end of life. With the strong tailwinds in the market and government support, there is significant opportunity to invest in new technologies to transform the value chain so as to increase operational efficiencies and unlock supply in the near-term. This is coupled by a clear demand pull from the mining majors and other market participants to purchase and utilize these technologies, reducing commercial risk and supporting the scale-out.” – Allen Chen, Investor, BMW i Ventures

Company Highlights:

- Maverick BioMetals (Seed) – sustainable bio-extraction of metals from hard rock

- Natrion (Series A) – solid-state battery technology that enables greater energy density, faster charging, and longer lifespan of batteries

- NanoGraf (Series B) – a novel high-energy-density silicon-based anode for batteries in a range of applications from military to consumer

- Components & Electronics

The battery pack is the heart of the electric vehicle, but there are many innovation areas in the way it integrates with other parts of the vehicle architecture (i.e. motor, power electronics, charging system, etc). Check out the Ridgeline article highlighting its investment thesis around electrifying commercial vehicles.

Insider Perspective: “Like passenger vehicle manufacturers, we’ve taken a vertically integrated approach to our product development, meaning that we build and integrate everything ourselves, including the chassis, battery system and drive train. It means we can deliver a cost competitive vehicle without compromising on performance, efficiency or durability.” -John Harris, Founder & CEO, Harbinger

Company Highlights:

- Harbinger Motors (Series A) – fully vertically-integrated electric chassis, with specialized powertrains and proprietary battery packs, for commercial and specialty vehicle industries

- Scalvy (Seed) – modular e-powertrains to help mobility OEMs accelerate and scale their internal development

- Twaice (Series B) – battery analytics software that enhances transparency and predictability of batteries

- Product Design

Startups have begun to challenge mobility OEMs with unique electric product designs and D2C business models, securing their supply chains and increasing their margins by forgoing the sale through a physical dealer network. Check out the Obvious Ventures article about Tesla alums and their mission to electrify RVs.

Insider Perspective: “It’s not just about building an electric product, it’s about building an electric product that’s built to last. A good product is one that you can buy and pass down to your kids.” -Toby Kraus, Founder & CEO, Lightship

Company Highlights:

- Lightship (Series B) – aerodynamic, battery-powered recreational camper trailers

- Arc Boats (Series B) – high-performance, electric water sport boats

- Telo Trucks (Seed) – compact electric vehicle trucks for city living and weekend adventuring

- Range Extension

Range anxiety with current electric products has led to new developments in lightweighting, power distribution, plug-in hybrids, and on-vehicle generators. Ram estimates that its 2025 1500 Ramcharger will be able to travel 145 miles on electricity alone, and when combined with a full tank of gas, the PHEV truck claims a combined range of up to 690 miles (see article for more details).

Company Highlights:

- Croft Motors (Seed) – decarbonizing vehicles and equipment with swappable hydrogen cartridges and base stations that produce affordable hydrogen on-site for fueling

- SparkCharge (Series A) – 100% turn-key mobile EV charging service for OEMs, fleets, and more

- Infrastructure

The lack of reliable infrastructure is a key barrier to the adoption of electric vehicles today, and the current workforce is not equipped with the resources and skill sets required to service and maintain these products. This article by MCJ Collective highlights their investment in WeaveGrid and the importance of proper EV charging infrastructure to support the energy transition.

Insider Perspective: “I have met many amazing entrepreneurs who are doing relevant things in the space – from hardware and software to services and installation. A lot of partnership opportunities have emerged as different players in the EV value chain understand that they rely on each other to push the entire industry forward.” -Tom Sun, Founder & CEO, AmpUp

Company Highlights:

- AmpUp (Series A) – EV charging software that helps business owners and property managers efficiently manage multiple charging stations

- BoxPower (Series A) – solar microgrids for utilities, critical facilities, off-grid power, agriculture, telecom, and EV charging clients

- ChargerHelp! (Series A) – national electric vehicle service equipment (EVSE)-dedicated operations and maintenance service provider

- Revoy (Seed) – electrifying the trucking space with swappable electric fifth wheels, converting existing diesel trucks into hybrids for enhanced fuel efficiency, extended range, and eco-friendly travel

- Adoption

Ushering in a new wave of electric products requires a change in user behavior that extends beyond just sustainability incentives, to economics and usability. Enterprises like Comcast are believers in a climate-smart future that lets homeowners take control of their home energy (see article for details).

Insider Perspective: “Battery storage is crucial in the race to net zero, because it solves one of the major barriers to renewable energy scaling: intermittency,” said Tommy Stadlen, Co-Founder, Giant Ventures, who led the round. “We are doubling down on our previous investment in the company after witnessing first-hand the extraordinary demand generated by what is one of the strongest teams building in the climate technology space globally.”

Company Highlights:

- Haven Energy (Series A) – Series A stage two-sided DER marketplace connecting residential consumers and SMBs with energy storage systems

- Bluedot (Seed) – simplifying EV charging payments with one app to find, pay and access thousands of charging stations

- Amber (Seed) – modern protection plans and repair services tailored to the EV ownership experience

Electrification is like gravity, it doesn’t care if you like it or agree with it… it’s happening. Our investment model uniquely positions us to navigate and capitalize on this evolving landscape across the entire electrification value chain. This ecosystem approach fosters alliances and collaborations that drive innovation forward, enabling OEMs to play a pivotal role in shaping the future of e-mobility. We know industry leaders must be proactive in preparing for this paradigm shift, and we are here to help.

Please contact us directly or reach out to declan@technexus.com if you are an enterprise, startup, or investor ready for a conversation.