U.S. businesses spent over half a trillion dollars on R&D in 2021. Most of this money was squandered on established technologies that will become obsolete in just a few years’ time. Instead of spending to keep up with the market, what if businesses were spending to anticipate the market?

Anticipating the market means deploying a portion of R&D capital on emerging technologies to position products, services and internal operations for the future. By making forward-looking decisions now, companies will preserve their relevance – saving money, saving time, and remaining competitive for years to come.

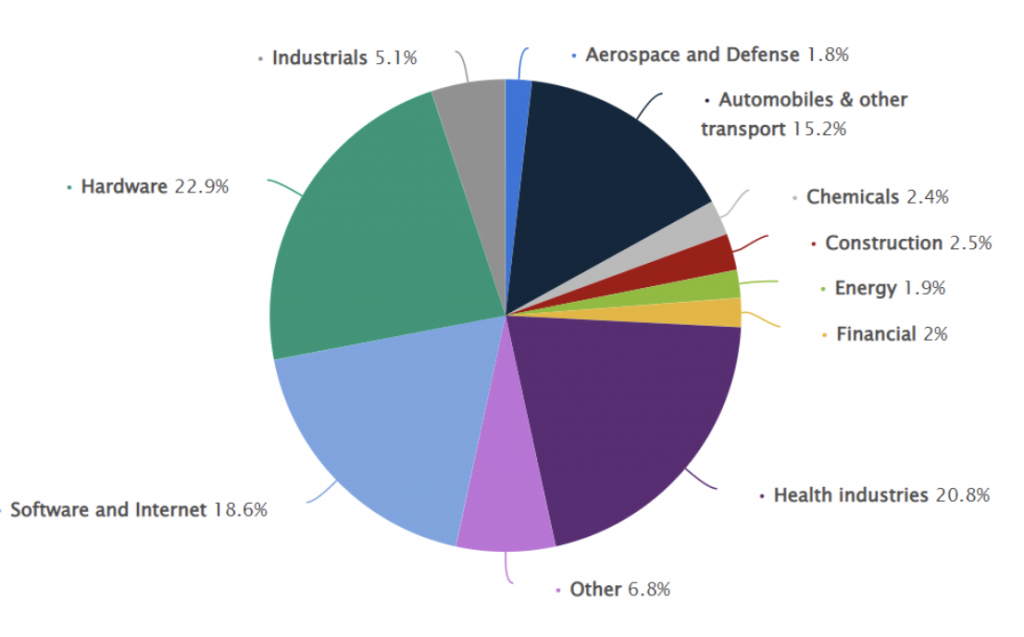

The ability to deploy capital for innovation is particularly important in industries driven by productivity and cost control.

Why Is This Important?

Companies in these industries have small innovation + R&D budgets and can’t afford to spend each year on technologies that will quickly become outdated. For example, the Aerospace and Defense industry is driven by cost control and,

- Comprises only 1.8% of global R&D spend (Figure 1)

- Operates under razor-thin overall profit margins (less than 5%)

So What?

Legacy technologies put people and businesses at risk. The recent slew of Southwest flight cancellations is a testament to this. Southwest Airlines’ legacy scheduling system crashed under high demand – leaving 62% of Southwest flights canceled and a whopping $825M in damage control., Thousands of other businesses face a similar fate unless they learn to deploy innovation capital efficiently.

Four Steps to Deploying Capital for Corporate Innovation

Step 1: Identify an Innovation Thesis

The first step in our process is to help our corporate partners to identify areas where innovation will have the biggest impact on their bottom line. We then leverage our deep expertise of the entrepreneurial landscape to develop an investment thesis around emerging technologies that can help to transform inefficient processes to revenue drivers.

Step 2: Invest in Emerging Technologies

Armed with these recommendations, we source thousands of startup companies from around the world aligned to the innovation investment thesis. We then invest small amounts of capital into these startups to help businesses unlock strategic and financial returns.

Step 3: Accelerate R&D

After investment, the fun really begins. We work with our corporate partners to collaborate with portfolio companies in a variety of ways including low-cost proof of concepts, pilot programs, co-development opportunities, and product demonstrations. Through these interactions, corporations save time and money by learning fast and early what works for their business and what doesn’t. Corporations also gain access to competitive insights, frontier market research, and the financial upside of a well-rounded venture capital portfolio.

Step 4: Position for Long-Term Viability

After building a well-rounded venture portfolio, we help our corporate partners to position their company for long-term viability. We do this through follow-on venture investments, collaborations at scale, M&A opportunities, corporate spin-offs, and more.

This process continues indefinitely as we work to position our corporate partners to collaborate, invest, and grow. Interested in learning more? Reach out to me at erin@technexus.com.

About TechNexus Venture Collaborative

For over a decade, corporations have relied on TechNexus to help them innovate through our proprietary four-step process – investing capital, resources, and expertise into emerging technologies. This cyclical, evolving process becomes the linchpin for corporations to create new revenue streams, and business models, and get access to entrepreneurial talent.

[1] https://ncses.nsf.gov/pubs/nsf22343

[2] https://www.nytimes.com/2022/12/28/travel/southwest-airlines-flight-cancellations.html

[4] https://www.statista.com/statistics/270233/percentage-of-global-rundd-spending-by-industry/