Expect to see a lot more #nature #sunrise #yogi Instagram posts in the coming years. The number of new, verticalized marketplaces and platforms facilitating outdoor experiences is reaching an inflection point.

The state of outdoor travel

In 2018, the US National Park Service received over 318 million recreational visits. With more than 400 sites, one of the best and most time-honored ways to see the U.S. is its robust system of national parks. However, of the 59 national parks in the U.S., only 19% of Americans have seen more than five. More than a quarter (26%) say they have never been to a national park. The majority (54%) say they have visited two or fewer.

Why outdoors?

When it comes to happiness with physical health and well-being, there is a 22 percentage point gap (61% to 39%) between travelers and homebodies. In the era of increasing concern over worker burnout, this finding is a notable takeaway for employees and employers looking for ways to improve well-being. In particular, travelers who commit to outdoor trips return 33% happier and more relaxed than their urban-traveling counterparts.

Thesis

New platforms will make outdoor experiences as easy to access and navigate as vacationing in a metropolitan area. Most millennials find setting up a hunting or fishing trip to be significantly more logistically challenging than flying to Chicago or NYC for a weekend to check out Eater’s top-rated avo-toast brunch spot.

It’s not that urban experiences are more fun or relaxing than outdoor alternatives. It’s the tools that make it easy… Skyscanner for optimal flight prices, Airbnb for the stay, Lyft to navigate anywhere, Google Maps as the citadel of restaurant reviews, OpenTable to confirm.

New outdoor-focused companies will compete on these two vectors —

New Land (Re-Manifest Destiny)

This isn’t simply about increasing the funnel for visitors to national parks, but creating new access points altogether by facilitating private landowners to set up their own parks. Companies like Tentrr and Hipcamp are in the process of aggressively accumulating thousands of new sites across the US, locking landowners into exclusive contracts that prevent competitors from setting up their own campsites. The face of outdoor America is rapidly changing. National parks may no longer be central hubs for outdoor activities.

This ‘new land’ is coming from:

- Farmers

- Commercial developers that own land, but are not ready to break ground

- Timber-fellers that own many hundreds of acres of forest that cannot be monetized until mined for wood

- Private estates

Better experiences

Outdoor experiences aren’t plug-and-play in the same way that urban experiences are. Rivers and mountainscapes were not architected by civil engineers and interior designers (mostly). While the established, well-worn hiking trails can be straightforward, newly-opened outdoor destinations will require localized guides and some degree of facilitation. In addition, a new majority of the customer segment will emerge — the inexperienced outdoorsman.

To this end, I’ve seen a rise of guide-led and experiential services.

Request For Startups

Tools for the coming cottage industries

Similar to professional Airbnb operators and OpenDoor home repair businesses, we may see a crop of cottage industries form as a result of these new platforms. This could mean opportunities to help certify new campgrounds staff members, security services, offline/off grid check-in tools, tent repair services (🤷♂️) etc.

Data aggregation and social groups

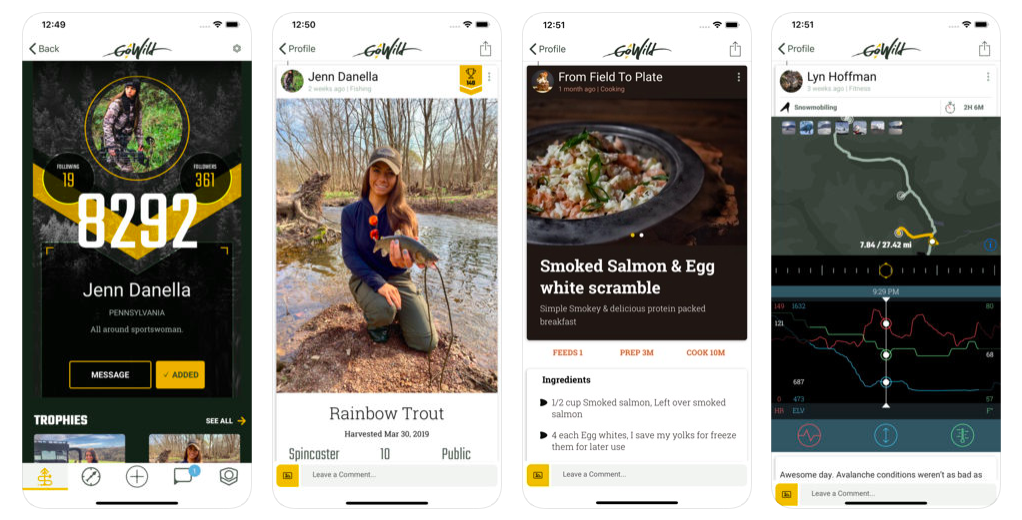

It’s not unusual that people who develop particular skills and interests like to connect with others who share the same. (The FB groups unbundling concept) For fishing, in particular, I’ve seen social apps like Fishbrain and Anglr accumulate thousands of active users. For hiking and camping, Alltrails and Hiking Project have been incredibly useful tools, totaling millions of downloads. Apps like GoWild are also gaining traction, helping hunters track and share trophy stats for various game.

Outdoor rewards programs

Potentially an interesting opportunity to create lock-in across outdoor activities by centralizing a rewards broker. This might grow the pie for all outdoor channels.